Service & Repairs

Because your tools work hard for you, they deserve the same care you give your clients.

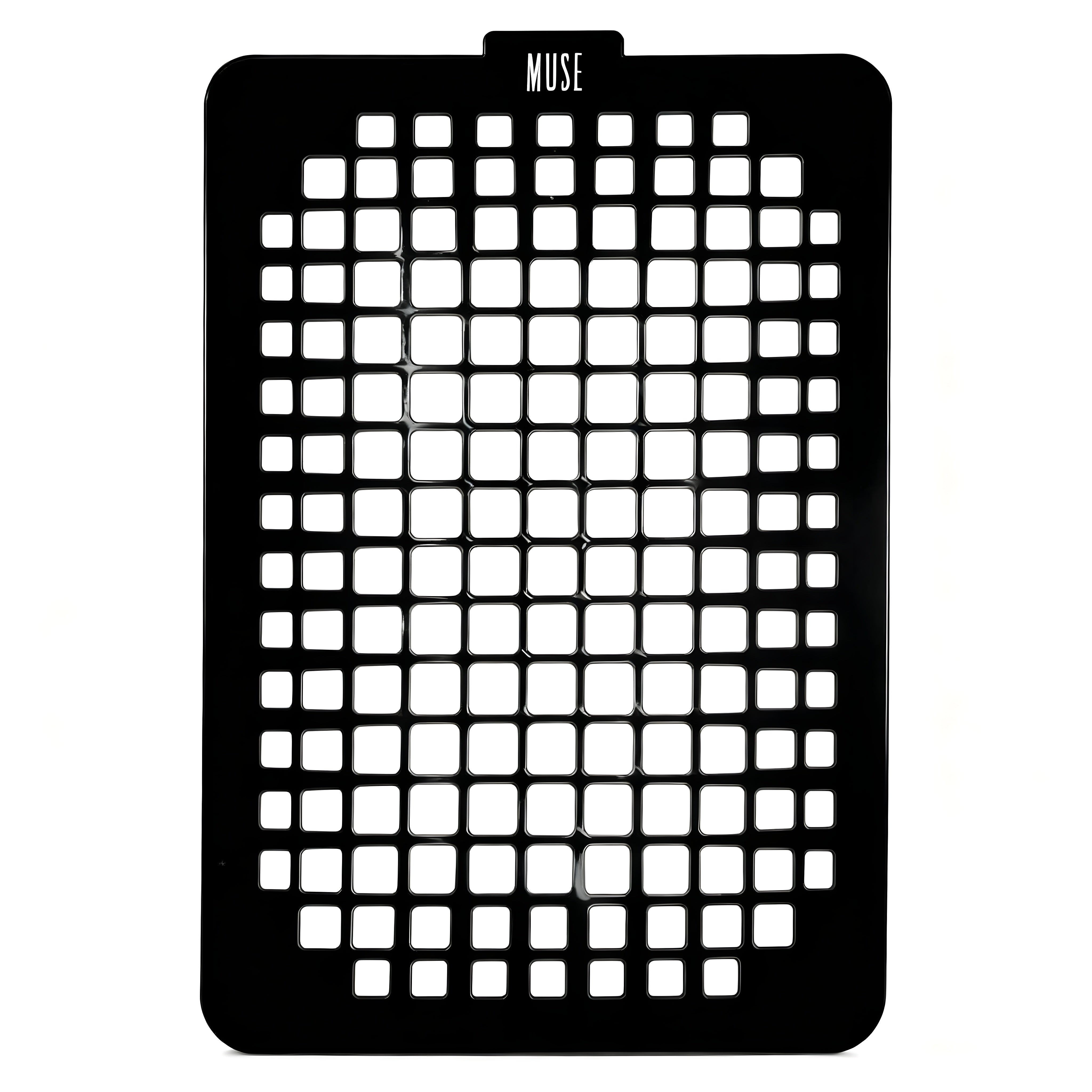

Our Service & Repairs Collection is designed to keep your MUSE essentials performing at their absolute best, helping you protect your investment and maintain the standard your clients expect.

Keep your tools flawless. Keep your service flawless.

FAQ'S

What is covered in my warranty?

???

How can I get a service?

Send us an email to hello@musefile.com and we'll talk you through the process!